I'm now in Atlanta, catching up from jetlag and preparing for what I expect is going to be a landmark event for WebRTC - probably the year's largest conference and exhibition on the technology, with rumours of 600+ attendees and a sold-out roster of sponsors.

I'm speaking this afternoon at the Business workshop along with organiser Phil Edholm, and fellow analysts Chris Vitek and Brent Kelly. I'm also moderating four panels over the next few days, on topics like SIP/WebRTC coexistence, WebRTC "game-changers" & the impact on telco business models. I'll also be on the wrap-up panel on Thursday, "beyond the call". Add to that being a judge for 50 or so 10-minute demos, numerous client meetings, briefings and dinners, and I think by the end of the week I'll be saturated in the current status of the WebRTC marketplace.

I've got a number of questions to answer, that I'll be looking for input for both directly and indirectly. It's often telling to see what people don't say, who is/isn't present, and meta-themes emerging when comparing multiple presetations or panel responses that gives a real clue.

Some of the topics to watch:

Overall, it's going to be a gruelling week, but by the end of it I expect to have got a much better "world view" of where WebRTC is, and where it's likely to be be by the end of 2013 and beyond. Feel free to come and say hello and/or chat over coffee or beer - and apologies if I'm dashing around like a lunatic for my next session.

On that topic: if you buy a licence for my WebRTC report before July 1st, I'll throw in the Q2 update I published a couple of weeks ago. And if you stump for an enterprise licence or a subscription to the updates (contact me for details), and I'll also add a 1-hour conference call to update on my thoughts from this week's show.

Details / payment here or else contact me via information AT disruptive-analysis DOT com

I'm speaking this afternoon at the Business workshop along with organiser Phil Edholm, and fellow analysts Chris Vitek and Brent Kelly. I'm also moderating four panels over the next few days, on topics like SIP/WebRTC coexistence, WebRTC "game-changers" & the impact on telco business models. I'll also be on the wrap-up panel on Thursday, "beyond the call". Add to that being a judge for 50 or so 10-minute demos, numerous client meetings, briefings and dinners, and I think by the end of the week I'll be saturated in the current status of the WebRTC marketplace.

I've got a number of questions to answer, that I'll be looking for input for both directly and indirectly. It's often telling to see what people don't say, who is/isn't present, and meta-themes emerging when comparing multiple presetations or panel responses that gives a real clue.

Some of the topics to watch:

- EDIT (forgot the obvious!) is WebRTC going to be driven more by adding Web-based access to existing types of RTC, or by adding RTC to the Web? eg Web-enabling RTC = browser front end to UC, IMS, contact centre; RTC-enabling Web = click-to-speak on a B2C site, or a million niche things like streaming sensor data, or adding karaoke to a music-download site

- At the moment, I think enterprise use-cases have a narrow real-world lead over both consumer web & telco applications of WebRTC. Will that be sustained?

- How far are we from seeing real, innovative applications of WebRTC actually in the world and being used? I don't mean just using it instead of a SIP softphone or as a cheaper call-centre agent desktop, but something really unexpected or headscratching

- Is the datachannel aspect of WebRTC really the hidden gem?

- How can I categorise and segment the WebRTC Gateway vendor space? Who's real and who's just playing Powerpoint-and-press-release? It's getting really competitive, and I suspect it'll end up as a few big players, plus niche focused specialists, plus a lot of "WebRTC-as-tickbox-feature". And some dead me-toos.

- How can I categorise the API/SDK/cloud bit of WebRTC vendor-land? I've lost count of the number I've encountered here - between 10-15 I think. Is it all about mobile? Is anyone doing anything *real* with WebRTC cloud platforms yet, or will it take developers a few more months to churn out the good stuff?

- Any news on the "missing"? Microsoft, Apple, IBM, Samsung, Amazon - please stand up! Bonus points for anyone doing a WebRTC mashup with face-recognition camera & LinkedIn profiles to spot any stealthy undercover representatives.

- Which telcos are lurking around? Who's willing to actually pipe up and say something beyond the usual culprits like AT&T & Telefonica/Tokbox?

- Who's here from Asia? All the signs are that WebRTC is under lots of scrutiny in China, Japan, Korea & Singapore. But little news on exactly what's being done....

- Where is Google taking all this? What can be inferred from what's left unsaid?

- Ditto for Cisco, Ericsson, Oracle - do they have big strategic games afoot? Or are they following the NSN & ALU view that WebRTC is just another front-end for IMS/VoLTE/(RCS)

- How much of the WebRTC vendor market will Open Source eat?

- What are the appropriate WebRTC market metrics for me to forecast in the future?

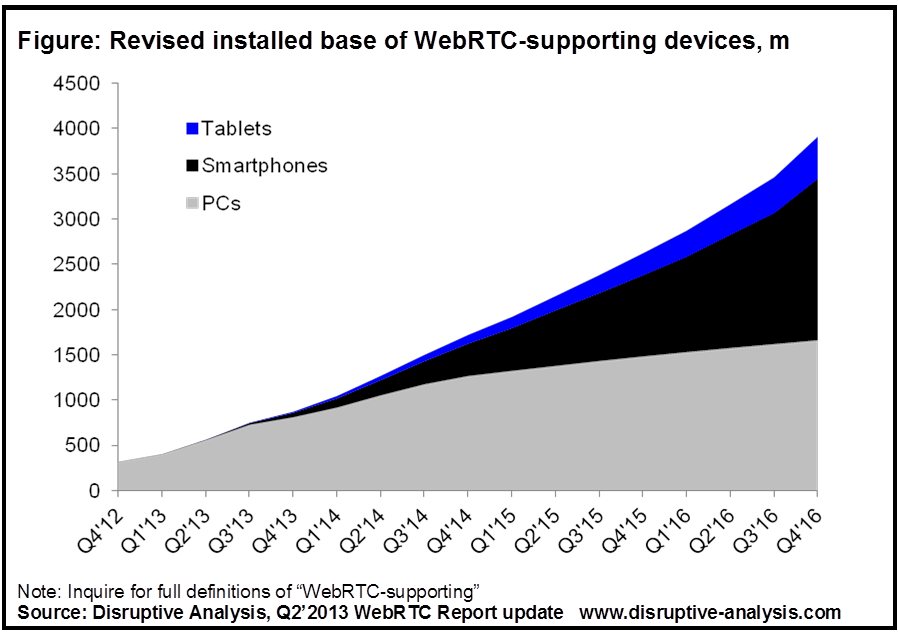

- Are my forecasts for devices support & user base growth too aggressive, or will I need to upgrade them again as I'm actually conservative?

- Will there be any seriously big unexpected announcements?

Overall, it's going to be a gruelling week, but by the end of it I expect to have got a much better "world view" of where WebRTC is, and where it's likely to be be by the end of 2013 and beyond. Feel free to come and say hello and/or chat over coffee or beer - and apologies if I'm dashing around like a lunatic for my next session.

On that topic: if you buy a licence for my WebRTC report before July 1st, I'll throw in the Q2 update I published a couple of weeks ago. And if you stump for an enterprise licence or a subscription to the updates (contact me for details), and I'll also add a 1-hour conference call to update on my thoughts from this week's show.

Details / payment here or else contact me via information AT disruptive-analysis DOT com